We are excited to introduce a range of enhancements and new features designed to significantly improve your overall wealth management experience with Sharpfin Wealth Management Suite.

Number of improvement highlights:4

Sharpfin state-of-the-art performance management feature allows for detailed analysis of portfolio contributions, while automatic TRS2 reporting ensures compliance with regulatory requirements.

Additionally, we've added functionality for Fondo portfolio transactions and enhanced the Client Portal with historical instrument performance and documentation. Learn more about how these updates can benefit your operations.

Improvement highlights:

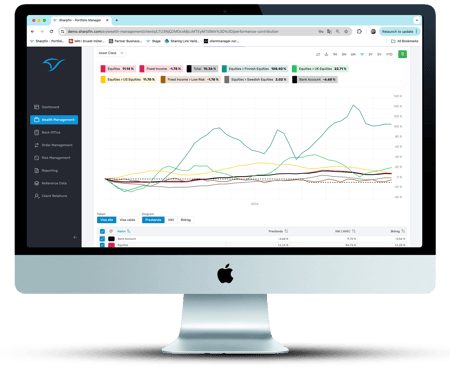

1. Performance Management

Sharpfin’s state-of-the-art feature for measuring performance contribution allows you to quickly and easily determine the origins of performance in a single portfolio or group of portfolios.

By utilising Sharpfin's flexibility in setting up generic classification structures, you can calculate and plot performance contribution on basically any characteristic of your portfolios.

For example, you can separate the performance of your equity and fixed income holdings and compare them to your alternative investments, or measure the performance of your sustainable investments against your non-sustainable investments.

Affected modules: New feature under Wealth Management module

2. TRS2 Reporting

Sharpfin now features automatic transaction reporting (TRS2) to your competent authority based on orders in the system. For most of our clients, this task has been executed by their custodian bank, but we have seen requirements from some of our clients where the custodian does not do this or if instruments are traded outside the custodian.

Affected modules: Reporting

3. Enhancement for Fondo Portfolio

We have added a functionality to deposit and withdraw holdings of the Fondo portfolios. Deposits are done via BG/OCR and withdrawals are done automatically based on a pre-defined account at the Fondo account.

Affected modules: Dashboard & Client Portal

4. Enhanced position and instrument information in the Client Portal

We have made it possible to show historic instrument performance and documentations related to instruments (s.a. KIDs) in the Client Portal.

This is mostly used by our clients who have Fondo portfolios but can easily be enabled for anyone who wants to offer this for their client base.

Affected modules: Client Portal